Your Guide to Restaurant Equipment Financing

Share

So, you need to outfit your kitchen, but dropping a mountain of cash on a new oven or walk-in cooler isn't exactly feasible right now. That's where restaurant equipment financing comes in.

It’s simply a way to get the gear you need—from prep tables to pizza ovens—without draining your bank account in one go. You secure funding through a loan, lease, or line of credit, which lets you spread out the cost over time. The best part? You can put that shiny new equipment to work making you money immediately.

Choosing Your Restaurant Equipment Financing Path

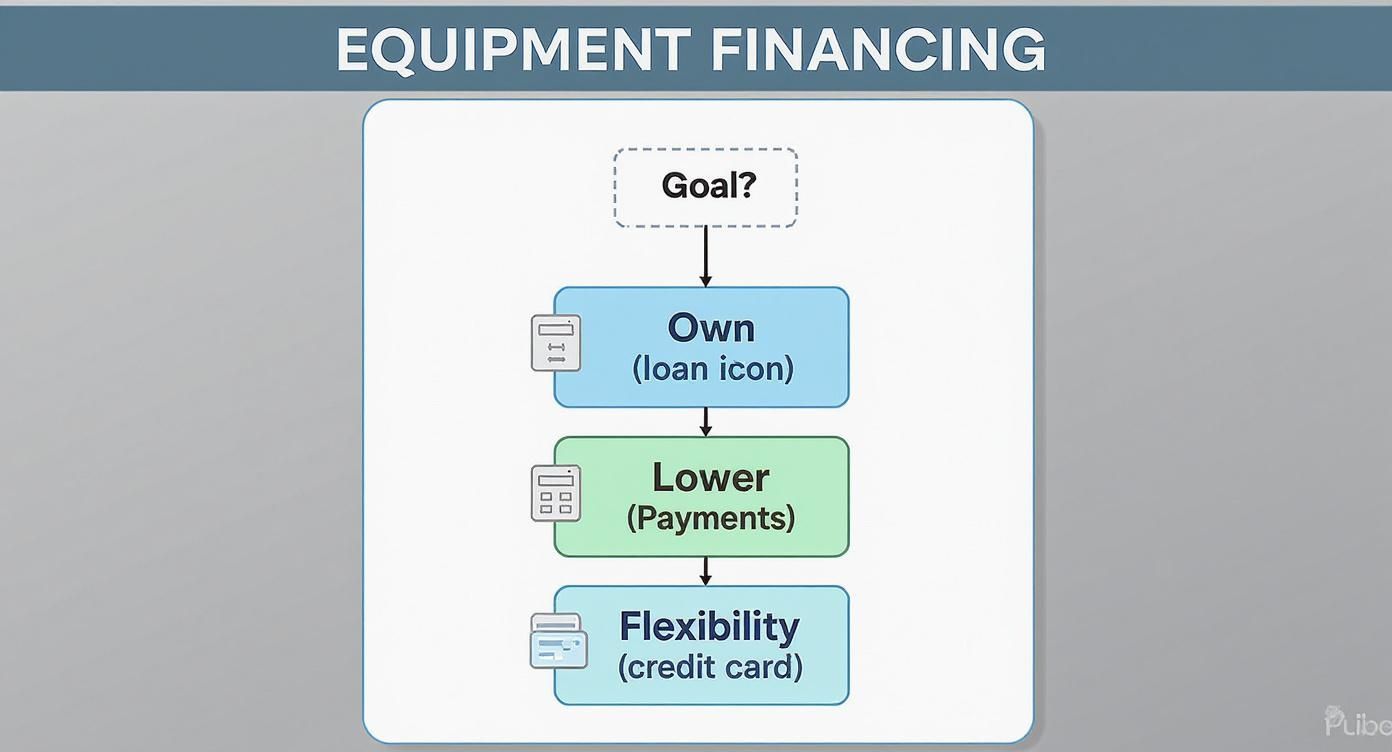

Funding your dream kitchen is a huge decision. The world of restaurant equipment financing might seem complicated, but it really just boils down to three main options, each built for different goals.

Think of it like getting a vehicle. Do you want to buy a truck outright and own it for the long haul? Would you rather lease a car for a few years with lower payments? Or do you need a flexible transportation budget you can dip into whenever a need pops up?

That's a perfect parallel for your three main choices: an equipment loan, an equipment lease, or a business line of credit. Each one has its own mix of ownership, payment structure, and financial impact. Getting a handle on these differences is the first step to making a smart investment in your restaurant's future.

This decision tree breaks it down: what's your main goal? Owning the asset, keeping payments low, or having maximum flexibility? Your answer points you straight to the right financing option.

As you can see, your strategy really dictates whether a loan, lease, or line of credit makes the most sense for your kitchen.

Let's break down these three paths so you can see which one feels right for you.

To make things even clearer, here's a side-by-side comparison of how these options stack up against each other.

Financing Options at a Glance Loan vs Lease vs Line of Credit

| Feature | Equipment Loan | Equipment Lease | Business Line of Credit |

|---|---|---|---|

| Primary Goal | Ownership | Low monthly payments | Flexibility for various needs |

| Ownership | You own it at the end | Lender owns it; you can buy it later | Not applicable; it's a cash fund |

| Payments | Fixed monthly payments (principal + interest) | Lower fixed monthly payments (rental fee) | Pay interest only on what you use |

| Best For | Core, long-lasting equipment (ovens, mixers) | Tech that becomes outdated (POS systems) | Unexpected costs, multiple small purchases |

| Upfront Cost | Usually requires a down payment | Low to no down payment | None, until you draw funds |

| Long-Term Impact | Builds equity; becomes an asset | Doesn't build equity | A revolving safety net for cash flow |

Each option has its place, and the best choice really depends on the specific piece of equipment and your financial situation at that moment.

The Equipment Loan The Path to Ownership

The equipment loan is the classic choice, just like getting a car loan for a vehicle you plan to drive for years. A lender gives you a lump sum to buy the equipment, and you pay it back—plus interest—over a set period.

Once you make that final payment, the equipment is 100% yours. This is the perfect route for foundational, built-to-last items like a commercial range or a heavy-duty mixer that will be the workhorse of your kitchen for a decade. Owning these items means you're building equity in your business.

The key advantage here is building equity. The equipment becomes a tangible asset on your balance sheet, which can strengthen your financial position for future funding needs.

The trade-off? Loans often require a down payment and can come with higher monthly payments than a lease. Lenders will also take a hard look at your credit score and business finances before giving you the green light.

The Equipment Lease Keeping Payments Low

Think of leasing as a long-term rental. You make lower monthly payments to use the equipment for a specific term, but you don't actually own it. This is a fantastic strategy for preserving your cash and for gear that goes out of date quickly, like POS systems or trendy new cooking technology.

When the lease is up, you typically have a few choices:

- Return the equipment and get the latest model.

- Renew your lease.

- Buy the equipment for its current market value.

That flexibility is a huge plus for a lot of restaurant owners. If you want to dig deeper into when leasing beats buying, check out our guide on equipment leasing vs buying.

The Business Line of Credit Ultimate Flexibility

A business line of credit is basically a credit card for your restaurant. Instead of getting a one-time lump sum for a specific purchase, you get access to a pool of cash up to a set limit. You can draw from it whenever you need to—for equipment, emergency repairs, or even inventory—and you only pay interest on the money you've actually used.

This is your go-to for maximum flexibility. Imagine your walk-in freezer suddenly dies on a busy weekend. A line of credit lets you solve that problem right now without scrambling to apply for a new loan. It’s an incredible tool for handling surprises and jumping on opportunities.

It's no surprise that more businesses are catching on. The global equipment finance market shot up by 10.4% in a single year, hitting a massive $1.437 trillion. That kind of growth shows just how valuable these flexible funding tools have become.

So, what kind of kitchen equipment can you actually finance?

Let's get practical. Financing isn't some vague concept; it's the tool that puts mission-critical equipment right into your kitchen. When a lender approves you for restaurant equipment financing, they aren't just handing over cash. They’re funding the very workhorses that generate your revenue—from powerhouse ovens to the unsung heroes on your prep line.

You can finance virtually any piece of commercial-grade equipment that has long-term value. This includes the big stuff like convection ovens, commercial ranges, and deep fryers. It also covers essential refrigeration like walk-in coolers and freezers. But the true backbone of an efficient kitchen is its prep space, which is why stainless steel tables are a top priority for financing.

Understanding Stainless Steel Prep Tables

Here's something you learn quickly in this business: not all prep tables are created equal. The material, design, and features all play a crucial role in your kitchen's hygiene and efficiency. Financing lets you invest in the right tables for each specific task without compromising on quality to manage upfront costs.

Types of Stainless Steel The two grades you'll see most often are 304 and 430. Think of them as different tools for different jobs.

-

304 Stainless Steel: This is the premium, "food-grade" stuff. It contains nickel, which gives it top-tier resistance to corrosion from salt, acids, and moisture. It’s exactly what you want for surfaces that are in direct, constant contact with food, like the countertop where you're dicing onions or portioning chicken.

-

430 Stainless Steel: This is the more budget-friendly option. It's still durable and easy to clean, but it's more likely to corrode over time, especially if it's exposed to acidic foods. It’s a solid choice for table legs, undershelves, or backsplashes—anywhere that isn’t constantly touching food.

Financing makes it possible to get a high-quality 304-grade worktable where it counts most. You'll meet health codes and get a surface that won't pit or rust, all while spreading the cost over time with manageable payments.

Specialized Prep Tables Are Efficiency Boosters

Beyond your basic work surfaces, restaurant equipment financing is perfect for getting specialized prep tables that are built to speed up specific jobs. These units combine refrigeration with smart workflow features, directly boosting your kitchen's output and consistency. They're high-value assets that absolutely pay for themselves by making you more efficient.

Investing in specialized prep stations is a direct investment in your kitchen’s speed and accuracy. By bringing refrigerated ingredients directly to the prep surface, you reduce staff movement, minimize cross-contamination risks, and ensure temperature-sensitive foods remain safe.

Two of the most popular and impactful types are pizza prep tables and sandwich prep tables.

Pizza Prep Tables These units are workflow machines. They typically have a wide work surface—often marble or refrigerated steel—with a refrigerated rail on top. That rail holds all your toppings in pans (cheese, pepperoni, veggies), right at your fingertips. Below, a refrigerated cabinet stores dough and extra ingredients. It’s an all-in-one design that lets a single person build pizzas fast, without ever leaving their station.

Sandwich and Salad Prep Tables The concept here is similar. These tables feature a cutting board running the length of the unit, right in front of refrigerated wells for your ingredients. This setup is perfect for delis, cafes, and quick-service spots, allowing for the rapid assembly of sandwiches, salads, and wraps. The built-in refrigeration keeps your produce crisp and meats fresh, ensuring every order is perfect.

If you want to see what's out there, you can explore the full range of commercial kitchen equipment available.

This constant need for better equipment is driving major growth. The restaurant equipment market, currently valued at $4.8 billion, is on track to more than double to $10.2 billion by 2035. This steady growth just shows how vital reliable, efficient tools are to the industry's success. You can find more details on this market trend from Future Market Insights.

What Lenders Really Look for in an Application

Getting a ‘yes’ on your restaurant equipment financing application is a lot easier when you learn to think like a lender. They aren't just punching numbers into a calculator; they're trying to build a picture of your restaurant's future. Once you understand their perspective, the whole process shifts from a stressful guessing game to a straightforward strategy.

At the end of the day, lenders are in the business of managing risk. Their number one question is simple: Can you and will you pay us back? To answer that, they focus on a handful of core areas that tell the story of your restaurant's reliability and stability.

The Big Three: Your Credit, Time, and Revenue

Think of your application as a three-legged stool. If one leg is wobbly, the whole thing feels unstable. Lenders pretty much build their entire decision around three pillars: your credit history, how long you've been slinging hash, and your annual revenue.

-

Credit Score (Personal and Business): This is the lender’s first, fastest look at how you handle your financial responsibilities. They'll pull your personal FICO score—often needing a minimum of 600-650—and check out your business credit profile. A solid score immediately tells them you have a history of paying your bills on time.

-

Time in Business: This is all about stability. An established restaurant with over two years under its belt has a proven track record, which makes you a much lower risk in a lender's eyes. A brand-new cafe, on the other hand, is still an unknown, so they'll dig a lot deeper into the other parts of your application.

-

Annual Revenue: This number shows your raw ability to take on new debt. Lenders need to see healthy, consistent cash flowing through your business. It gives them the confidence that you can easily make the monthly payments without putting your operation under stress.

For instance, a five-year-old pizzeria pulling in $500,000 a year that wants to finance a new deck oven is a completely different story than a six-month-old coffee shop that needs its first big espresso machine. The pizzeria’s history gives a reliable forecast of its performance, while the startup has to lean heavily on its projections and the owner's personal credit strength.

The Story Your Documents Tell

Beyond the raw numbers, lenders want to see the why. They need to understand where your business is going, and that’s where your business plan and financial statements come in. These documents are your best storytelling tools.

A well-written business plan doesn’t just ask for money; it explains precisely why that new equipment is a smart move. It should clearly show how a new walk-in cooler or a more efficient prep line will increase revenue, cut costs, or make your kitchen run smoother. This proves you've thought things through like a true operator.

Your financial documents are more than just paperwork; they are proof of your restaurant's health and potential. Clean, organized statements build trust and show lenders you are a serious, competent operator.

Your financial statements—like your profit and loss reports and balance sheets—are just as critical. They give a transparent, no-fluff look at the health of your restaurant. Lenders also want to see that you can handle future payments, which is why detailed cash flow projections are so important. Getting a handle on essential cash flow forecasting methods can give your application a serious edge.

This focus on future growth is a great sign for the restaurant industry. Confidence is high, with more than half of all operators planning to spend more on equipment and supplies. This trend really drives home the critical role that restaurant equipment financing plays in helping restaurants grow and improve all across the country.

A Step-by-Step Guide to the Application Process

Applying for restaurant equipment financing can feel like a huge chore, but it doesn't have to be. I like to think of it as prepping for a busy service—get all your mise en place ready, and everything runs smoothly. If you're organized, you can sail right through it.

The whole thing really comes down to three main stages: getting your paperwork in order, filling out the application, and then talking through the offer. Nailing each step is how you show lenders you're a serious operator who’s ready to grow.

Step 1: Gather Your Essential Documents

Before you even start looking at applications, you need to pull together your restaurant's financial story. Lenders need to see the numbers to understand your business's health and feel confident you can pay them back. Having everything ready to go from the start makes a great first impression.

Here's a quick checklist of what you'll almost always need:

- Business Bank Statements: Lenders want to see your cash flow. Plan on providing the last three to six months of statements to show them your revenue is consistent.

- Tax Returns: Have two to three years of both your personal and business tax returns handy. This gives them the bigger picture of your financial track record.

- Equipment Quote: You can't finance something without knowing what it costs. Get an official quote from your supplier that lists the specific equipment and the total price.

- Business Plan: This is especially critical for newer restaurants. A solid plan that clearly explains how this new equipment will make you more money is a game-changer.

Step 2: Complete and Submit the Application

With all your documents organized, it’s time to actually fill out the application. The golden rule here is simple: be honest and be accurate. Every single detail matters, from your restaurant's official name to your monthly sales figures.

Even a small mistake can look like a red flag to a lender and get your application tossed out. They're going to verify everything anyway, so being upfront is always the best approach. Tell your financial story with confidence.

Step 3: Review and Negotiate the Offer

Getting an offer in your inbox is a great feeling, but don't just sign it and send it back. This is where you can save yourself a lot of money and future headaches. Read through every single line of that agreement.

An offer is not a final command; it's the start of a conversation. Never hesitate to ask questions or negotiate terms that don't align with your restaurant's financial goals.

Before you agree to any restaurant equipment financing deal, make sure you get clear answers to these questions:

- What's the Annual Percentage Rate (APR)? Don't just look at the interest rate—the APR includes all the fees and shows you the true cost.

- Are there prepayment penalties? You don't want to be punished for paying off your debt ahead of schedule.

- What are the exact late payment fees?

- Is the interest rate fixed or variable? A variable rate could jump up later, which means your payments would, too.

By tackling the application one step at a time, you turn a stressful process into a strategic one. This is how you put your restaurant in the best possible position to get the funding for the gear you need to thrive.

Calculating the True Cost of Your Financing

That shiny new oven's sticker price? It's just the starting point. When you're looking at restaurant equipment financing, the initial price tag is only one piece of a much larger puzzle. To make a truly smart decision for your kitchen, you have to dig deeper and figure out the real, total cost of borrowing money.

Think of it like buying a car. The MSRP is what gets you in the door, but the final cost is all about the interest rate, the loan term, and any fees the dealer rolls into the deal. Financing your kitchen equipment works the exact same way. Getting a handle on these details is the only way to compare apples to apples and protect your restaurant from nasty financial surprises down the road.

Beyond the Interest Rate

When a lender slides an offer across the table, it's natural for your eyes to jump straight to the interest rate. It’s important, for sure, but it doesn't paint the whole picture. To see what you’re really signing up for, you need to zero in on a few other critical numbers.

-

Annual Percentage Rate (APR): This is your most important number, period. The APR bundles the interest rate plus any extra lender fees, like origination costs. It shows you the true annual cost of the loan. Always, always compare offers using the APR, not just the interest rate.

-

Origination Fees: This is a one-time fee the lender charges you just for setting up the loan. It's usually a percentage of the total loan amount and is often taken right out of the funds you receive, so it's an upfront cost you need to account for.

-

Total Cost of Borrowing: This is the big one—the sum of every single payment you'll make, including all the principal and interest, over the entire life of the loan. A lower monthly payment might look tempting, but if it comes with a longer term, you could end up paying a whole lot more in total interest.

For example, a $10,000 loan at 8% interest might seem better than one at 7% that has a $500 origination fee. But when you calculate the APR, that second loan could easily be the cheaper option in the long run.

To see how this plays out, let's look at a common scenario: buying a new commercial oven.

Sample Cost Breakdown Loan vs Lease for a $20,000 Oven

| Cost Factor | Equipment Loan Example | Equipment Lease Example |

|---|---|---|

| Equipment Cost | $20,000 | $20,000 |

| Term Length | 5 years (60 months) | 5 years (60 months) |

| Interest Rate/Factor | 7% APR | 1.4 Factor Rate |

| Monthly Payment | ~$396 | ~$467 |

| Total Payments | ~$23,760 | ~$28,020 |

| End of Term | You own the oven | Option to buy for Fair Market Value (e.g., $2,000) |

| Total Out-of-Pocket | $23,760 | $30,020 |

As you can see, while the loan has a higher monthly payment initially, the total cost of owning the oven is significantly lower by the end. The lease offers flexibility, but that convenience comes at a higher long-term price.

Uncovering Potential Hidden Costs

A good financing deal is a transparent one. Still, you’ve got to be your own advocate and keep an eye out for clauses that could trip you up later. These "hidden" costs are almost always buried in the fine print, so it really pays to read every single line before you put ink to paper.

The best financing deals aren't always the ones with the lowest monthly payment. They're the ones with total transparency and the fewest surprise costs, keeping your budget predictable and your mind at ease.

Two of the most common costs to watch for are:

-

Prepayment Penalties: Believe it or not, some lenders will hit you with a fee if you try to pay off your loan early. Why? Because they're losing out on all the future interest they were banking on. Always ask if there’s a penalty before you sign.

-

Late Fees: Every loan has them, but they can vary dramatically. Make sure you know the exact fee and how long of a grace period you have before it kicks in.

Don't forget that tax incentives can also massively change the long-term financial picture. For instance, utilizing bonus depreciation to cut your tax bill can dramatically lower the net cost of your new equipment. When you factor in these advantages, financing quality gear like a durable stainless steel prep table becomes an even smarter move. If you're deciding between new and pre-owned, our guide on used stainless steel tables can help you make a cost-effective choice.

How to Improve Your Odds of Getting Approved

Getting a “yes” on your restaurant equipment financing application isn’t just luck—it’s about solid preparation. Lenders are always looking for a compelling, low-risk investment, and it’s your job to show them your restaurant is exactly that.

Taking a few strategic steps before you even start the paperwork can massively boost your chances. Think of it as prepping for a VIP dinner service. You wouldn’t just toss ingredients on a plate; you’d carefully craft every element. Your financing application deserves the same attention to detail.

Build a Strong Business Credit Profile

One of the very first things a lender will pull up is your business credit score. This number is a quick snapshot of your financial reliability, and it’s completely separate from your personal credit.

A healthy business credit profile demonstrates a history of responsible borrowing and paying your bills on time, making you a much more appealing applicant.

Here’s how to whip it into shape:

- Establish Trade Lines: Start by opening accounts with suppliers who report your payments to business credit bureaus. Consistent, on-time payments are the single fastest way to build a positive history.

- Keep Debt Low: High balances on your business credit cards or existing lines of credit can look like a red flag, much like with personal credit.

- Monitor Your Reports: Pull your business credit reports regularly to check for errors. You’d be surprised how often a simple mistake can unfairly drag down your score.

Craft a Compelling Business Plan

Your business plan is your chance to tell the story of your restaurant's growth and profitability. It needs to do more than just ask for money; it has to clearly show how this new equipment will directly fatten your bottom line. Lenders need to see a clear path to a return on their investment.

Your plan should get specific about how that shiny new pizza oven or walk-in cooler will increase sales, cut down on labor costs, or make your kitchen more efficient. Use real projections. For example: "This new six-burner range will let us expand our catering output by 25%, which we estimate will add $5,000 in monthly revenue." Suddenly, you’ve turned a simple request into a smart business decision.

A great business plan doesn't just list what you need; it maps out your future. It's your most powerful tool for convincing a lender that funding your restaurant is a winning bet.

Have a Down Payment Ready

Walking into a negotiation with cash already on the table instantly makes you a stronger candidate. While some financing options don't require it, offering a down payment shows lenders you have skin in the game. It proves you’re financially stable and serious about this investment.

A down payment, usually around 10-20% of the total equipment cost, reduces the lender's risk. In return, this often gets you better interest rates and more favorable terms. It’s a powerful signal that you’re a responsible and well-prepared borrower.

Compare Offers from Different Lenders

Finally, whatever you do, don't take the first offer that lands in your inbox. The world of restaurant equipment financing is packed with options—from traditional banks and online lenders to equipment specialists, all competing for your business. Each one has different rules and offers unique terms.

Take your time to gather a few different offers and compare them side-by-side. Look past just the interest rate and dig into the APR, any hidden fees, and the repayment schedule for each one. Doing this homework ensures you don't just get approved, but you get the best possible deal for your restaurant's financial future.

Got Questions About Restaurant Equipment Financing? We've Got Answers.

Even the clearest plan can leave you with a few lingering questions. It’s completely normal. Let’s walk through some of the most common things restaurant owners ask so you can move forward with total confidence.

Can I Finance Used Equipment?

You absolutely can. In fact, most lenders are more than happy to finance used equipment, and it can be a brilliant way to make your budget go further.

The process is pretty much the same as financing brand-new gear. The only difference is the lender might ask for an inspection report or an appraisal, just to confirm the equipment's condition and fair market value. This is often a fantastic strategy for those workhorse pieces like prep tables or convection ovens that have a long, reliable life ahead of them.

What’s the Minimum Credit Score I’ll Need?

This is a big one, and while every lender plays by slightly different rules, a personal FICO score somewhere in the 600 to 650 range is a common starting point. If you want the best rates and terms, especially from traditional banks, you'll have a much easier time with a score of 680+.

But don't panic if your score isn't there yet. Many alternative lenders are more flexible on credit, though you can expect to see higher interest rates to offset their risk.

Just remember, your credit score is only one part of the story. Lenders look at the whole picture, and factors like how long you've been in business and your monthly revenue carry a lot of weight.

How Fast Can I Actually Get the Money?

The answer really depends on where you go. The timeline can vary wildly.

- Traditional Banks & SBA Loans: Think marathon, not a sprint. Because of their in-depth approval process, you could be looking at several weeks or even a month-plus from the day you apply to having the funds.

- Online Lenders & Equipment Specialists: These guys are built for speed. It's not uncommon to get an approval in 24-48 hours and have the cash in your account in just a handful of business days.

Bottom line: if a critical piece of equipment goes down and you need a replacement yesterday, an online lender is almost always your fastest route.

Is It Possible to Finance Equipment with No Money Down?

Yes, it's definitely possible, and a lot of restaurant owners go this route. Many equipment leases and some loans (especially from online lenders) are set up to require little or no down payment. This can be a game-changer for preserving cash, particularly if you're just starting out.

That said, putting some skin in the game by offering a down payment—typically 10-20%—can make your application much stronger. It shows the lender you're serious and lowers their risk, which can often land you a better interest rate and a more favorable deal in the long run.

Ready to outfit your kitchen with the best? PrepTables.com offers a massive selection of NSF-certified stainless steel prep tables, commercial refrigeration, and cooking equipment designed for durability and efficiency. Find the perfect gear for your restaurant at https://preptables.com.